Όπως κάθε χρόνο, η Κοινωφελής Επιχείρηση του Δήμου Θεσσαλονίκης βρίσκεται κοντά σας για να σας ενημερώσει αναλυτικά για τη διαδικασία και τα δικαιολογητικά που θα χρειαστείτε προκειμένου να υποβάλλεται εμπρόθεσμα την αίτησή σας για εγγραφή των παιδιών σας στα Κέντρα Δημιουργικής Απασχόλησης Παιδιών και Ατόμων με Αναπηρία που διατηρεί.

Βασική προϋπόθεση για την συμμετοχή στη διαδικασία είναι να διατηρεί η κάθε αιτούσα προσωπικούς κωδικούς στο taxisnet.

Θα χρειαστείτε έγγραφα που αφορούν στην Α. οικογενειακή, Β. οικονομική και Γ. εργασιακή σας κατάσταση. Διαβάστε παρακάτω και συγκεντρώστε τα δικαιολογητικά σας ανάλογα με την κατηγορία στην οποία υπάγεστε.

Το χρονοδιάγραμμα υποβολή αιτήσεων και των απορρεόντων αποτελεσμάτων έχει ως εξής:

Φάσεις Υποβολής Αιτήσεων – Αποτελέσματα Ημερομηνίες

Υποβολή Αιτήσεων 19/7 –03/8/2021

Προσωρινοί Πίνακες Αποτελεσμάτων 09/8/2021

Υποβολή Ενστάσεων 10 -12/8/2021

Οριστικοί Πίνακες Αποτελεσμάτων 13/8/2021

Α. ΠΙΣΤΟΠΟΙΗΤΙΚΟ ΟΙΚΟΓΕΝΕΙΑΚΗΣ ΚΑΤΑΣΤΑΣΗΣ που να έχει εκδοθεί μετά την 31η/12/2020 και

α) σε περίπτωση που η μητέρα είναι αλλοδαπή και η χώρα καταγωγής της δεν εκδίδει πιστοποιητικό οικογενειακής κατάστασης, τότε θα πρέπει να προσκομίσει οποιοδήποτε άλλο ισοδύναμο επίσημο έγγραφο, το οποίο να πιστοποιεί την οικογενειακή κατάσταση, συνοδευόμενο από επίσημη μετάφραση εάν δεν είναι διαθέσιμο στην ελληνική γλώσσα από την Αρμόδια Αρχή (Πρεσβεία ή Προξενείο ή Υπ. Εξωτερικών)

β) Σε περίπτωση που η/ο ενδιαφερόμενη/νος είναι πολίτης που αιτείται άσυλο, αντίγραφο κάρτας ασύλου ΚΑΙ οποιοδήποτε επίσημο έγγραφο από την Ύπατη Αρμοστεία ή από άλλους οργανισμούς που πιστοποιεί την οικογενειακή του κατάσταση

γ) Σε περίπτωση ανύπαντρης μητέρας (μονογονεϊκή οικογένεια), πιστοποιητικό οικογενειακής κατάστασης της αιτούσας.

στ) Σε περίπτωση που η/ο ενδιαφερόμενη/νος είναι χήρα/χήρος, απαιτείται και ληξιαρχική πράξη θανάτου του συζύγου, εάν η χηρεία δεν αναφέρεται στο πιστοποιητικό οικογενειακής κατάστασης,

δ) Σε περίπτωση διάζευξης απαιτείται αντίγραφο διαζευκτηρίου (από τη Μητρόπολη για θρησκευτικό γάμο ή από το Δήμο για πολιτικό γάμο), εάν η διάζευξη δεν αναφέρεται στο πιστοποιητικό οικογενειακής κατάστασης ή το έντυπο μεταβολών ατομικών στοιχείων της Δ.Ο.Υ. (Μ1) στο οποίο θα αναγράφεται η διάζευξη.

ε) Σε περίπτωση που η ενδιαφερόμενη τελεί σε διάσταση, απαιτείται το έντυπο μεταβολών ατομικών στοιχείων της Δ.Ο.Υ. (Μ1) με ημερομηνία προγενέστερη της πρόσκλησης ή αντίγραφο από την Προσωποποιημένη Πληροφόρηση του taxisnet

στ) Σε περίπτωση ύπαρξης συμφώνου συμβίωσης απαιτείται και η προσκόμισή του, καθώς και τα εκκαθαριστικά σημειώματα για το φορολογικό έτος 2020 και των δύο μερών.

ζ) Σε περίπτωση ανάδοχου γονέα, απαιτείται αντίγραφο πράξης αναδοχής σε ισχύ από τις αρμόδιες επίσημες αρχές

η) Σε περίπτωση που ο ενδιαφερόμενος άνδρας έχει την επιμέλεια των παιδιών του, απαιτείται και δικαστική απόφαση της επιμέλειας του παιδιού ή αντίγραφο πράξης Συνεπιμέλειας

Β. ΠΡΑΞΗ ΔΙΟΙΚΗΤΙΚΟΥ ΠΡΟΣΔΙΟΡΙΣΜΟΥ ΦΟΡΟΥ (ΕΚΚΑΘΑΡΙΣΤΙΚΟ ΣΗΜΕΙΩΜΑ) για το φορολογικό έτος 2020 (δηλαδή για εισοδήματα που αποκτήθηκαν από 1/1/2020 έως 31/12/2020) και των δύο γονέων.

Εάν το παιδί κάνει δική του φορολογική δήλωση απαιτείται και

η πράξη διοικητικού προσδιορισμού φόρου (εκκαθαριστικό σημείωμα) για το φορολογικό έτος 2020 του παιδιού.

Γ. ΔΙΚΑΙΟΛΟΓΗΤΙΚΑ ΑΠΑΣΧΟΛΗΣΗΣ

α) Μισθωτή: Αυτόματη Άντληση Στοιχείων από το ΕΡΓΑΝΗ

β) Απασχολούμενη με Περιστασιακή Απασχόληση με Εργόσημο:

– Βεβαίωση εργοδότη υπογεγραμμένη, από την οποία προκύπτει ότι συνεχίζεται η απασχόληση της, με ημερομηνία έκδοσης μετά την δημοσίευση της Πρόσκλησης

– Εργόσημο (αντίγραφο και απόδειξη κατάθεσης σε τράπεζα του τελευταίου 12μηνου, που να αποδεικνύει εργασία τουλάχιστον 2 μηνών) ή σε περίπτωση αυτασφάλισης, 50 ένσημα εντός των τελευταίων 12 μηνών

γ) Απασχολούμενη με τίτλους κτήσης – Δελτίο Παροχής Υπηρεσιών:

– Αντίγραφο Σύμβασης με 1 τουλάχιστον εργοδότη, εντός του τελευταίου 12μηνου ΚΑΙ Βεβαίωση Απογραφής στο Ενιαίο Μητρώο ΕΦΚΑ

δ) Απασχολούμενη ως εργάτρια γης (ασφαλισμένες ΕΦΚΑ – ΟΓΑ):

– Βεβαίωση εργοδότη ΚΑΙ Βεβαίωση ΕΦΚΑ (πρώην ΟΓΑ) τελευταίου τριμήνου που να αποδεικνύει εργασία τουλάχιστον 2 μηνών

ε) Απασχολούμενη εκτός πρωτογενούς τομέα (ατομική επιχείρηση):

– Αντίγραφο Δήλωσης Έναρξης Επιτηδεύματος στη ΔΟΥ

– Βεβαίωση Ασφαλιστικού Φορέα ότι η αιτούσα είναι ασφαλισμένη (και σε περίπτωση οφειλής) ή ότι έχει καταβάλλει τις εισφορές ή Έγγραφο ειδοποίησης του Ασφαλιστικού φορέα για καταβολή εισφορών

– Υπεύθυνη Δήλωση του Ν. 1599/86 περί μη διακοπής της άσκησης του επιτηδεύματος

στ) Απασχολούμενη που συμμετέχει σε Ο.Ε. ή Ε.Ε. ή Ι.Κ.Ε. ή Ε.Π.Ε. ή ΜΟΝΟΠΡΟΣΩΠΗ Ε.Π.Ε. (σε περίπτωση Α.Ε. δικαίωμα έχουν μόνο τα έμμισθα μέλη)

– Το αρχικό καταστατικό (σε περίπτωση μεταβολών και τελευταία τροποποίηση αυτού)

– Πιστοποιητικό περί μη λύσης από το ΓΕΜΗ

– Υπεύθυνη Δήλωση του Ν. 1599/86 περί μη διακοπής της άσκησης του επιτηδεύματος

– Βεβαίωση Ασφαλιστικού Φορέα ότι η αιτούσα είναι ασφαλισμένη (ακόμα και σε περίπτωση οφειλής) ή ότι έχει καταβάλλει τις εισφορές ή Έγγραφο ειδοποίησης του Ασφαλιστικού φορέα για καταβολή εισφορών ή σε περίπτωση εταίρου Ι.Κ.Ε. Υπεύθυνη Δήλωση του Ν. 1599/86 του Διαχειριστή της εταιρίας Ι.Κ.Ε. ότι η ενδιαφερόμενη απασχολείται κανονικά στην επιχείρηση.

ζ) Αυτοαπασχολούμενη στον πρωτογενή τομέα:

– Βεβαίωση ασφαλιστικού φορέα ότι η ενδιαφερόμενη είναι άμεσα ασφαλισμένη ή Έγγραφο ειδοποίησης του Ασφαλιστικού φορέα για καταβολή εισφορών (σε περίπτωση οφειλής)

Δ. ΑΝΕΡΓΙΑ

Εάν η ενδιαφερόμενη είναι άνεργη/άνεργος, απαιτούνται:

– Δελτίο ανεργίας ΟΑΕΔ σε ισχύ

– Σε περίπτωση που η αιτούσα έχει σύζυγο ή σύντροφο (σύμφωνο συμβίωσης) άνεργο, απαιτείται Δελτίο Ανεργίας ΟΑΕΔ σε ισχύ και του συζύγου.

Ε. ΔΙΚΑΙΟΛΟΓΗΤΙΚΑ ΑΝΑΠΗΡΙΑΣ

·Εάν η ενδιαφερόμενη μητέρα (καθώς και η ανάδοχη μητέρα) ανήκει στην ομάδα των ΑμεΑ ή/και ο σύζυγος:

– με ποσοστό αναπηρίας 35% και άνω για τη μητέρα ή/και για ένα από τα τέκνα της: απαιτείται Αντίγραφο Βεβαίωσης Πιστοποίησης της Αναπηρίας σε ισχύ από Κέντρο Πιστοποίησης Αναπηρίας (ΚΕ.Π.Α.) με την χρονική διάρκεια ισχύος και το ποσοστό αναπηρίας,

– με ποσοστό αναπηρίας 67% και άνω για το σύζυγό της: απαιτείται Αντίγραφο Βεβαίωσης Πιστοποίησης της Αναπηρίας σε ισχύ από Κέντρο Πιστοποίησης Αναπηρίας (ΚΕ.Π.Α.) με την χρονική διάρκεια ισχύος και το ποσοστό αναπηρίας.

· Εάν η ενδιαφερόμενη μητέρα έχει ανήλικο παιδί ΑμεΑ απαιτείται:

– Αντίγραφο Βεβαίωσης Πιστοποίησης της Αναπηρίας σε ισχύ από Κέντρο Πιστοποίησης Αναπηρίας (ΚΕ.Π.Α.) με την χρονική διάρκεια ισχύος και το ποσοστό αναπηρίας

· Εάν η ενδιαφερόμενη μητέρα έχει ενήλικο παιδί ΑμεΑ απαιτείται:

– Αντίγραφο Βεβαίωσης Πιστοποίησης της Αναπηρίας σε ισχύ από Κέντρο Πιστοποίησης Αναπηρίας (ΚΕ.Π.Α.) με την χρονική διάρκεια ισχύος και το ποσοστό αναπηρίας

– απόφαση δικαστικού συμπαραστάτη σε ισχύ (αφορά ΟΛΑ τα άτομα μεΑ άνω των 19 ετών) ΚΑΙ αντίγραφο ληξιαρχικής πράξης γέννησης

· Εάν το παιδί κάνει δική του φορολογική δήλωση απαιτείται και

η πράξη διοικητικού προσδιορισμού φόρου (εκκαθαριστικό σημείωμα) για το φορολογικό έτος 2020 του παιδιού.

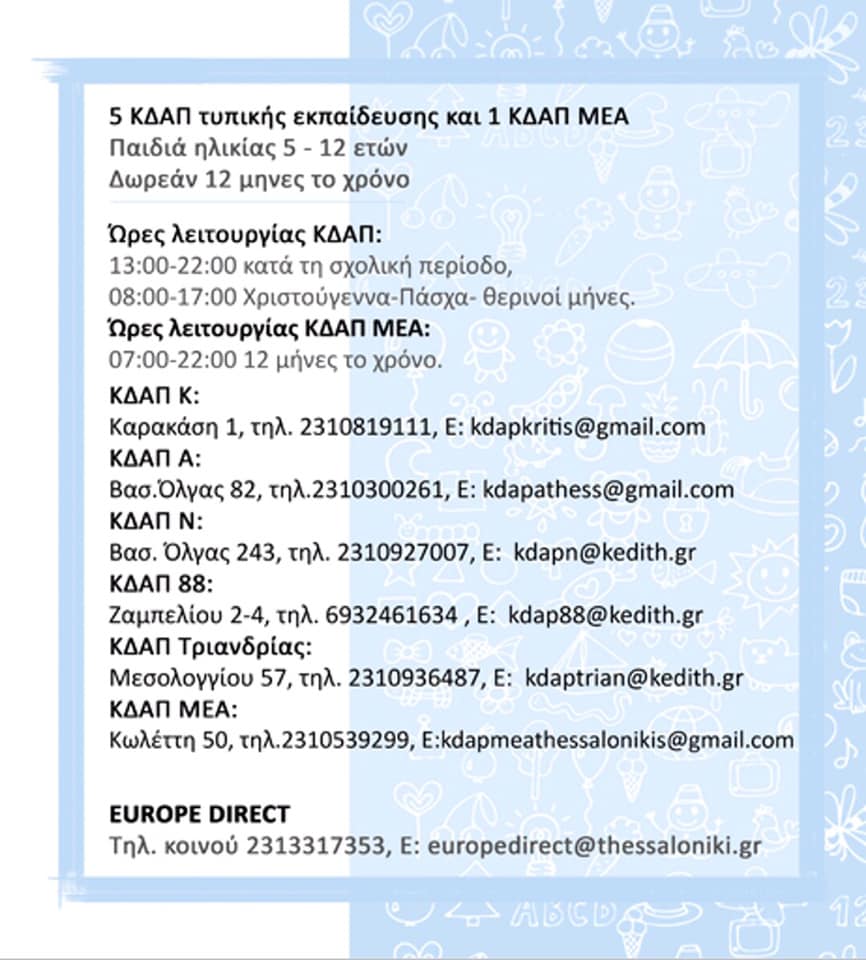

Το προσωπικό της Κοινωφελούς Επιχείρησης του Δήμου Θεσσαλονίκης βρίσκεται κοντά σας σε κάθε βήμα και μπορείτε να απευθύνεστε στις δομές μας για κάθε είδους διευκρίνιση, βοήθεια ή περαιτέρω πληροφορία.